Priority:

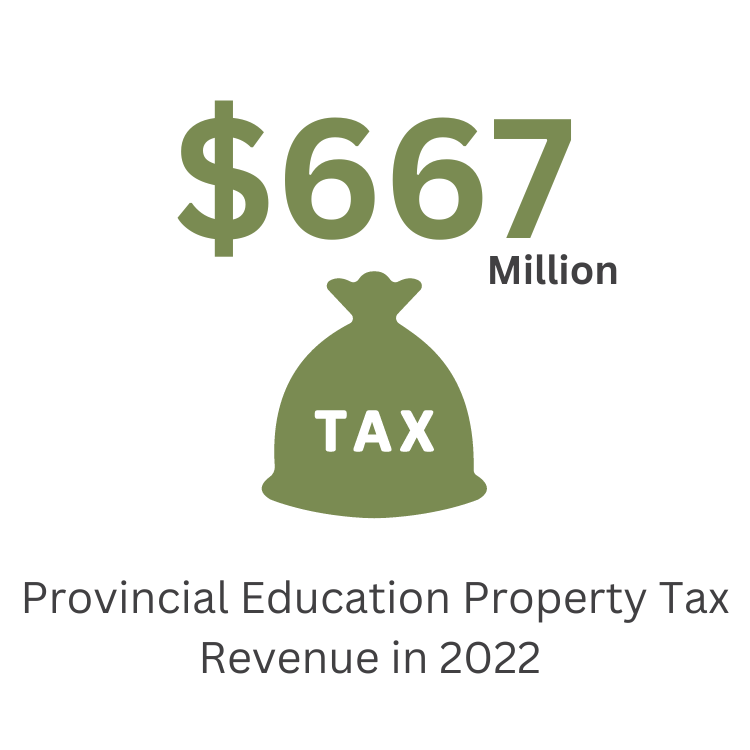

Removal of the education property tax from farm property

KAP's Recommendation

KAP believes any education funding model should be focused on key principles of equitable access to education, fairness for ratepayers who support education through taxes, and having stable, predictable funding for long-term success of the education system.

Farmers are shouldering an inequitable share of the cost of education through the school division special levy.

-

Farmers pay a disproportionate amount of education property tax due to the amount of land required to produce agricultural products.

With property valuations as the baseline for the current education property tax and funding model, an increase in farmland value can result in extreme tax increases in a single year for farmers.